The world has gone digital overnight, and if you slept in, then you are likely witnessing your market being kidnapped by fintech companies and disruptive startups with diversified product and service models.

Why is this happening?

In short, consumers aren’t the same as they once were. Their needs have evolved with the technology available, and they don’t have time for the old “let’s book an appointment” ways. The only way that you can battle to regain grasp on your market is by arming yourself with the best cloud tech available and by expanding your offering to meet more of your clients needs—rather than just dealing in dollars and cents.

Skip the reading and see how Vendasta can help financial service providers today!

Table of Contents

The Challenges That Banks Face

Consumers are Changing

The Robots are Coming

The Competitive Landscape for Financial Services

Financial Startups

FinTechs

Big Banks and Credit Unions that are Beating you to the Punch

Amazon, Facebook, and Other Big Brands

Strategies for Growth: Banks and Credit Unions

1. Leverage Client Relationships

2. Diversification: Killing Turnover

3. Take the Fight to the Cloud

The Challenges That Banks Face

The financial industry has almost always been a secure and consistent one (except for that one time in 2008). 20 years ago, it would have been difficult to imagine the financial industry as being one that could be at risk, but that day has arrived, and the entire sector is ripe for disruption. It’s been a slow process, but years of stagnant business models have driven new era competitors into the financial industry, and this shift is beginning to leave banks and credit unions facing numerous challenges.

Consumers are Changing

Today, consumers are expecting more, demanding it faster, and in need of better results. In fact, according to an annual survey conducted by The Financial Brand, 61% of industry experts, bankers, and consumers from around the globe agree that the top trend in coming years will be removing friction from the customer journey.

The Robots are Coming

Not even Arnold Schwarzenegger could stop the wave of robots that’s on the way. But by saying robots, I don’t mean a bunch of T-1000’s, what I do mean is that automation and artificial intelligence are redefining the power balance across the entire B2B sector—including financial services.

With so many service industries moving to better serve their customers, and serve them faster, the expectation is that banks will be following in suit.

The Competitive Landscape for Financial Services

Banks, credit unions and other financial service providers are facing numerous threats in the evolving business landscape. Twenty-five years ago, it would have been hard to imagine that such a stable industry would be under assault by startups and the tech sector, but that is exactly what’s happening today.

With the evolution of new, accessible business and consumer technology comes the crop of digital-first providers moving in on that share of the market.

Financial Startups

The startup, full of heart and short on fear, has begun to throw jabs at larger financial institutions.

The scary part? They’re landing.

They’re landing because these startups are attacking banks in their credit, lending, payments, and payroll services—and they’re landing 5 shots before many financial institutions can even start to defend themselves. This is happening because so many banks are slow moving and rigid compared to their fast and flexible competitors. Banks and credit unions need to make some major organizational adjustments if they want to keep up with their new competitors.

For example, where it takes most large banks roughly 3 weeks to process certain loans, many of these disruptive startups are able to complete the same process for a similar loan in 7 minutes. They might even be getting away with a higher interest point simply because they can give their clients the help they need as soon as they need it.

They are enabled by cloud computing, devout of costly on-premise tech, and they have an easy time attracting younger talent through vibrant silicon cultures—not to mention that customer facing entrepreneurial zeal that stands in sharp contrast with the by-the-book approaches of many banks and credit unions.

FinTechs

According to a survey conducted by PwC, over 80% of financial institutions believe core business is at risk to innovators. FinTechs are these innovators, and they have the ability to completely transform the financial user journey and the banking industry as a whole.

A FinTech can be loosely defined as a company that leverages technology to improve the efficiency of financial services. Disruption is the goal of these companies, so any innovation in this sector has been tied or attributed to the work of FinTechs (ex. the bitcoin). On the lower end of the spectrum are companies that are innovating in areas such as financial literacy or retail banking—and on the higher end you’d find loan pairing companies like Fundera.

FinTechs pose a threat to traditional banks and credit unions as they are not bound by the preconceptions of what it has historically meant to be a “bank”. The sky is truly the limit, and disruptions such as the introduction of the bitcoin have the ability to reshape the very definitions of currency and exchange in the finance sector.

Big Banks and Credit Unions that are Beating you to the Punch

It’s the digital evolution in banking. The time is now, and every minute you wait is another opportunity for your competitors to make the move that you’re thinking about and start stealing your market share.

According to a study by Econsultancy, 33% of financial service organizations plan to invest significantly in digital skills and education in 2019, and a further 50% intend to invest somewhat. And the reward warrants the effort. According to McKinsey, banks and credit unions that have already automated processes and residual operations see an improvement of over 50% in productivity and customer service efficiency.

Amazon, Facebook, and Other Big Brands

With the likes of Mark Zuckerberg and Jeff Bezos seemingly on quests to be all things to all people, it’s important to recognize that these big businesses have a realistic possibility of diversifying into the financial sector. Large corporate brands have the power, tools, and resources necessary to diversify into banking territory, and are backed by their powerful international reputations. This poses a major (albeit silent) threat to businesses operating in the financial services industry, such as banks and credit unions.

Strategies for Growth: Banks and Credit Unions

You were probably starting to wonder if there was going to be any sunshine in this post. Good news, the clouds are clearing up and the forecast is full of sunshine. By following a few key strategies, banks and credit unions can fight back and maintain their stronghold in the financial sector—and maybe even creep into new sectors with the right diversification strategy.

1. Leverage Client Relationships

Banks and financial service providers already have great relationships with their clients. The lending relationship is one that is founded on a complex understanding, and a high degree of trust. With this trust, many clients look to banks for advice and consultation that extends beyond the lending partnership.

By leveraging this relationship, banks can better serve their clients by adding products and services to their offering that extend beyond financial ones. One easy way to instantly grow an offering is by partnering with white-label product and service providers. These types of partners would allow a bank to instantly enter new markets or compete for new shares of wallet without the overhead or capital that would otherwise be required.

Recommended Reading: The Ultimate Guide to White-Label Products & Solutions

2. Diversification: Killing Turnover

If you are an exclusive financial service company, but some of your closest competitors are offering business coaching, reselling cloud based solutions, and offering marketing services in addition to their lending services—who do you think the client is going to prefer to work with? Digital is changing the way that banks do business, and by providing you clients with a more diverse offering, you can achieve a few things:

- Protect revenue by meeting more of your clients needs.

- Grow your bottom line by earning a greater share of wallet from valuable customers.

- Strengthen your current offering by aligning products/services and creating new bundles to offer your clientele.

- Stay competitive by giving yourself a unique solution advantage over others in your sector.

- Reduce risk factors by giving your clients the additional solutions and guidance they need to succeed, and not placing all of your eggs in one basket.

3. Take the Fight to the Cloud

Banks and credit unions are going to have to elope with the cloud if they haven’t already, or else face the consequences. Every company that is achieving massive success in 2019 is either cloud based or one of the internet behemoths above that own the clouds.

As a result of security and reliability concerns, financial service providers are among the slowest industries to migrate to the cloud, but there are some key reasons why banks and credit unions should take cloud-adoption very seriously:

- Cost reduction. By closing data centers and substantially reducing the capital that is tied up in IT, banks and credit unions can become increasingly competitive.

- Agility. The cloud is this magical land where you only pay for exactly what resources are used. This gives banks the ability to scale storage, memory, and processing power without concern for wasting unused capacity.

- Security. Banks are under constant attack, and they have been breached. Major cloud service providers deliver top-class security and safety for their clients and their data, so only the best people and access management systems are employed by these providers.

- Simplicity. Standard public cloud architecture is much more simplified than the often complex mash-up of hardware and software that formulate the on-premise architecture of many banks and credit unions currently.

- Reseller models. By entering the cloud sphere, banks can further the growth of their diversification strategies by becoming resellers of best-in-class cloud solutions.

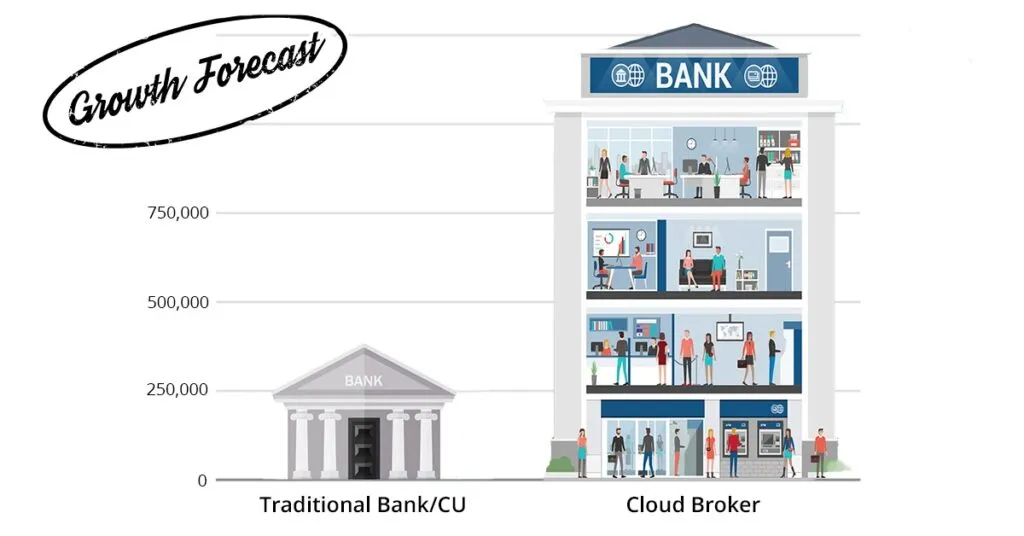

The New World

With automation and shifting consumer behaviors re-shaping the face of banking and lending services, battles with your competitors are not going to be fought over interest rates and securities. Battles will instead be won through an exceptional user experience and a diversified product and service model. By bundling financial services with new cloud services and solutions banks and credit unions can be well equipped to tackle evolving consumer needs.

Are you ready to become a bank of the future? Are you ready to become a cloud broker?

But, what is a cloud broker?

“Much like a stock broker acts as an intermediary between buyers and sellers, a cloud service broker essentially acts as an intermediary between cloud solution sellers and cloud solution purchasers.”

Final Thoughts

It’s not too late, you actually showed up just in time. You can arm yourself for battle with startups, fintechs, and the likes of Bezos, you just have to remember a few things:

- Leverage your client relationships.

- Diversification is the competitor killer.

- And take the fight to the cloud.

Vendasta’s powerful cloud broker platform and solutions revolutionize the way that banks and credit unions do business and foster customer relationships. By partnering with Vendasta, financial service providers acquire the power to instantly become resellers of dozens of the best-of-breed cloud solutions in the world. Some of our partners include: Google, Microsoft, MyCorporation, GoDaddy, and many more.

With Vendasta, our vendor partners become your vendor partners, instantly enabling you to start selling solutions from these cloud giants, as well as dozens more. Instantly expand your solution set and meet new needs from traditional media, to business operations, to marketing.

The financial service provider of tomorrow will be a full service cloud broker.