This blog is a guest post contributed by Rick Yates. Yates is CEO at MSP-X, a specialist go-to-market consultancy supporting technology vendors to drive success in the SaaS and IT services software market. Connect with Rick here.

Getting software products into the MSP market is challenging, some vendors enter the market and knock it out of the park, but many more try and fail. The truth is, numerous moons need to align to make it happen. Here's a few things that I've seen trip MSP vendors up along the way.

1. They don't build a deep understanding of the MSP market before entry

The MSP community is special. Here we have a group of people who are community focused, highly technical, deal savvy and can often be religious about the technology brands they partner with.

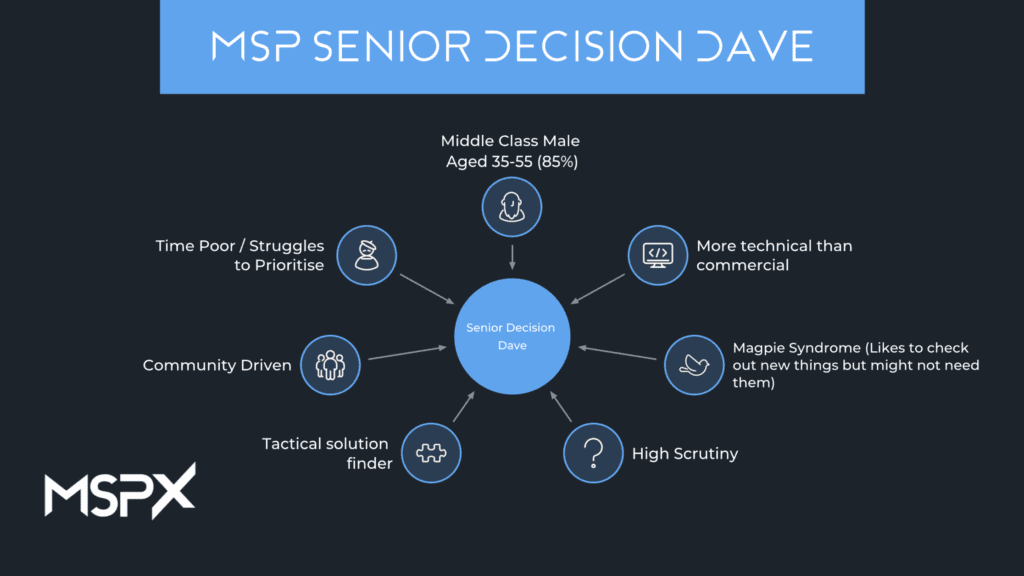

An example of an MSP buyer persona

Whether it's on Reddit, Facebook, LinkedIn or via one of the numerous MSP specific communities, these people talk to each other. There are literally hundreds of communities, many of which are listed in this great article by Jay McBain at Forrester.

Getting to know (and being well represented in) the community is imperative for any vendor to succeed, not in order to create leads, but so they can understand the needs, challenges and buying habits of MSPs and integrate this knowledge into their go-to-market plan.

MSP buyers have an advanced level of technical knowledge and highly scrutinize any product they are going to buy, they are also usually long standing business owners. They know how to spot a vendor, salesperson or product that isn't being straight with them, or will make their experience complicated, and are often comfortable to walk away.

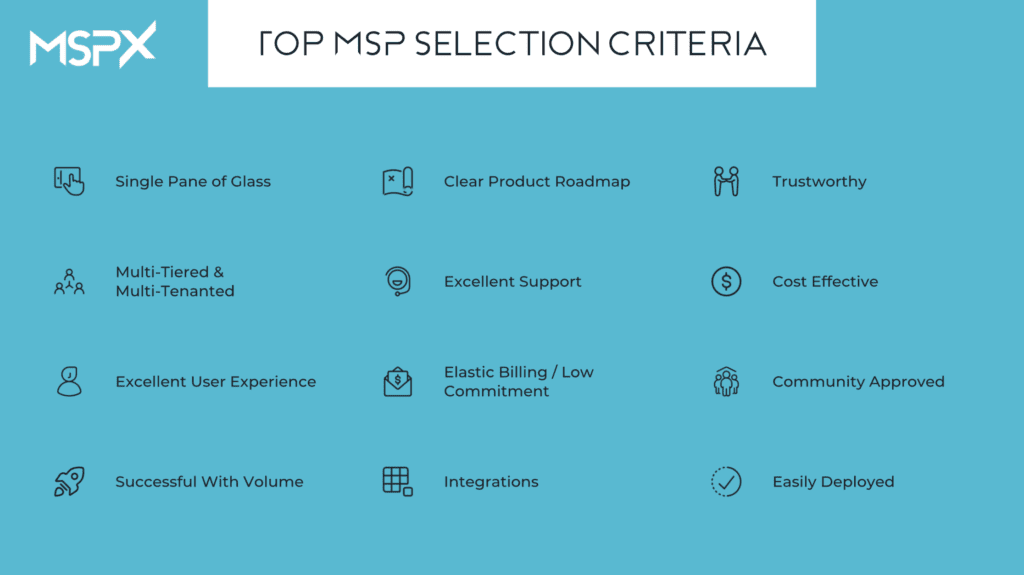

A buyer persona is a representation of the person in the business who buys the product you are selling. Many vendors in the MSP space have not yet done the work on truly understanding just what makes an MSP tick outside of the technological feature set. The vendors that have, are typically those that get to market faster and more effectively.

2. Going to market with an enterprise tool that has not been adapted for the MSP space

The burgeoning MSP market is an increasingly attractive space for enterprise vendors, with an increasing number of enterprise businesses (almost 70%) stating that they are reaching out to MSPs to fill skill gaps in their businesses. Check out this article by Joe Panettieri at Channel e2e to get the full lowdown on MSP/MSSP sector growth.

Many corporate enterprise vendors see the MSP/MSSP opportunity as low hanging fruit because they already have a product that carries multi-tenanted, multi-tiered deployment and management features that would be useful for MSPs. Vendors turn to their existing sales team and channel partners and task them with making sales to MSPs. Unfortunately, making the leap from enterprise into MSP, isn't this straight forward.

To win in the MSP space, products need to be rationalized for the market and key changes need to be made in UX, licensing, provisioning, billing, sales and marketing.

Key changes include the following:

- Make the product cloud native

- Switch out any multi-portal access in favour of a single central console, ensuring that this includes a remarkable look and feel

- Introduce options for flexible or elastic billing, allowing your MSP/MSSP to pay based on live usage (minimum license commitments are not an absolute "No", but we see lower commitment on entry leading to improved engagement)

- Ensure that your distribution partners can handle incrementally changing MRR. This is an operational challenge many distributors are still trying to overcome

- Realign your sales process. Enterprise sales can take months, but MSPs often evaluate then buy within 30 days

- Develop an MSP specific sales team with an established leader in the space

- Provide immediate access to product trials and pre-recorded demo. Don't make MSPs wait days for a discovery call, by that point they are already trialing another solution

All of this takes some time, money and patience. However, it is a go-to-market approach that the best MSP vendors are utilizing right now.

3. Under-resourcing on post sale technical support

MSPs are in the business of keeping other businesses running.

This means they are responsible for deploying and managing business critical tools for their customers. The idea that these tools might go-down and the MSP might not be able to instantly access high caliber support is enough to keep even the most seasoned Technical Director awake at night.

The standard support offering for MSP vendors is a 1 hour resolution, 24/7/365. In reality, this might mean that the MSP gets a scripted response from a low level engineer 7 time zones away, and when you have servers down or data at risk this is the opposite of helpful.

Vendors can be keen to invest in sales, but reluctant to properly resource the post sale support team. This is hugely damaging because not only do the MSPs end up leaving, but they jump into those forums we talked about earlier and let their peers know exactly what has happened.

The vendors that win with MSPs are those who can have a direct technical conversation with a high-caliber engineer in-country in less than a minute. That's the standard all MSP vendors should be striving for and whilst potentially expensive, it's absolutely worth the investment.

4. Compensating salespeople for annual (or multi-annual) contract bookings

MRR is more likely to be stable, predictable and when a customer leaves it has a lower impact than it does if you lose one substantial annually billed customer.

However, the downside is that it takes longer to build meaningful cash in the bank simply because vendors are receiving only 1/12 of the cash they would if they sold an annual deal, and in many cases the customer only needs to provide 30 days notice to cancel.

It's surprising how many MSP focused vendors are offering a monthly billable product, but still encouraging (and rewarding) their MSP sales team for landing annually billed deals, or multi year tie-ins with incrementally increasing minimum commitments. Lot's of MSPs get trapped by deals like this and typically the vendor does not back down when the MSP needs to cancel or adjust the agreement.

Cash flow is vital for any business of course, but operating in this way means that MSPs typically get a bad deal because they are being encouraged to sign up for longer term, higher license commitments than they really need to, just so the sales guy gets comped on his annual contract value figures and his CRO has good contract retention on paper.

Before long, the vendor ends up offering complex, highly discounted 3 year ramp deals that take months to close (most of which do not meet their intended revenue potential). In this situation the MSP typically needs dozens of cycles to get the deal done, whereas a flexible monthly agreement billed on usage might have closed the deal in 14 days, the MSP would have deployed the product across their entire estate in their own time anyway and the salesperson could have closed many more deals in the time saved.

This issue also undermines vendor company valuations. Engaging in an MSP strategy is about building a meaningful MRR business with a high number of sticky customers, which in turn increases multiples on exit. Altering this approach for more cash within the quarter undermines the strategy and increases the time it takes to succeed.

5. Expecting traditional channel distribution partners to operate on a "Plug and Play" basis and grow MSP business.

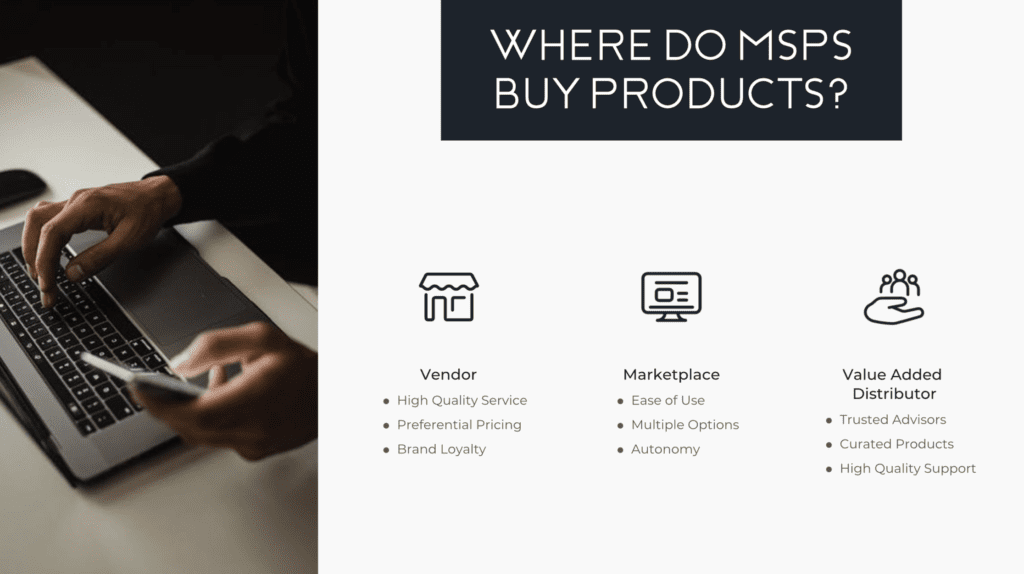

For decades now distributors have been selling software via resellers. Resellers are a very different buyer persona to an MSP. When selling to resellers you are selling through them to an end user who requires a product. When selling to an MSP you are selling directly to the organization who will not only be using the product, but will typically be evangelize its benefits and deliver it as part of a service.

An MSP product typically requires incrementally changing monthly recurring billing, which many traditional distributors are still understanding how to handle. Most distributors also have annual deal compensation plans in place for their sales people that don't suit the MSP software sales sector.

Expecting a traditional resale distributor to take an agile approach and start selling to MSPs on your behalf can be unrealistic, unless that distributor has made it clear to you that they have invested in making the vital required changes to their operation - which is costly and time consuming.

Many traditional distributors are introducing recurring revenue/MSP focused options, but there is still a way to go on this being a seamless experience for MSPs. This has meant that vendors have been focused on direct sales to MSPs and representation in self serve marketplaces in recent years and this trend is likely to continue unless there are distribution options that are highly MSP focused.

6. Panicking about lower value monthly recurring revenue deals

Flip-flopping on strategy is bad for any business, but a common theme that I see in the MSP software space is when senior leadership teams look at the profit and loss sheet for the quarter and start hyperventilating over the fact that MSPs are signing up and starting with small license counts. What happens next is they encourage revenue teams to follow the money and go after non-MSP or multi-annual deals. Leaders who have spent years working on larger enterprise deals are particularly vulnerable to this, because they look at the numbers and it can feel like chicken feed.

There are a few important things we know about the MSP market.

- 80 percent of MSPs in EMEA are SMBs (small and medium-sized businesses) - meaning smaller deals in high volume.

- MSP buyers start with a product and gradually deploy to their estate over time, they don't sign up all their customers at once.

- Many successful products will see 100 percent to more than 250 percent growth in an MSP within the year. The three year forecast is much more attractive.

Many MSPs are comfortable in signing a monthly billed annual agreement, as long as they really trust the product. However, the trend for truly MSP centric vendors is leaning towards monthly committed elastic billing, and this is becoming the standard expectation of many MSPs.

7. Leading with the argument that their technology is the best

The truth is that most vendors do have a USP or feature that other vendors don't, and they lean on this to claim that their technology is the best, because they think that's what MSPs care about.

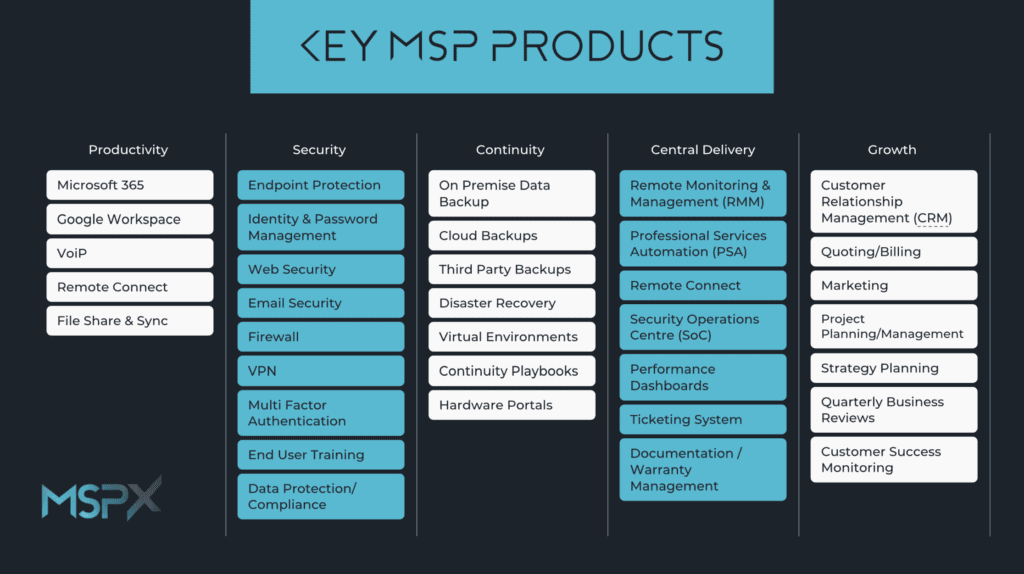

The problem is that there are 20-40 products that a well functioning MSP needs in their stack. This means that MSPs will often be evaluating a product of some kind on an infinite basis. The key thing they hear from vendors is "we have the best technology."

MSPs know that there are many, many vendor products available in each product category these days and the truth is they all do pretty much the same thing. What REALLY makes the difference is the stuff that is going to make life easy for the MSP and increase the chance they can make some money.

Easy to access support, a product that actually does what it says it will, fair pricing, monthly elastic billing, self provisioned licenses, a simple centrally managed cloud console and a trusted regular contact at the vendor. These are all things that will resonate with MSPs and buy you more trust than trying to convince everyone that you are best in market because of your tech.

Remarkable service and customer experience is what wins for MSPs, and if it is really good, MSPs will champion your product.

8. Setting prices that don't fit the market

Pricing can be particularly challenging for MSP software vendors, especially those operating in multiple regions around the world. Obviously, software vendors want to make as much revenue as possible and often feel inclined to set prices high and see how the market responds.

The challenge is that most MSPs are charging their customers a cost per user per month and will be reluctant to increase the amount they charge just because they have introduced a new or alternative tool that will make their lives easier - especially if the benefit is not obvious to a non-technical end user.

MSPs will also rank products based on functionality vs price. If you have a new-to-market product that is not as mature as your competitor, MSPs will expect that it should be cheaper in comparison.

Unless you have a genuinely staggering product and a lack of competitors, the sweet-spot is to create an increased feature set than that of your closest competitor at a price that is at least 30 percent cheaper. This makes selecting your product a no-brainer for MSPs and you will start to see largely increased uptake.

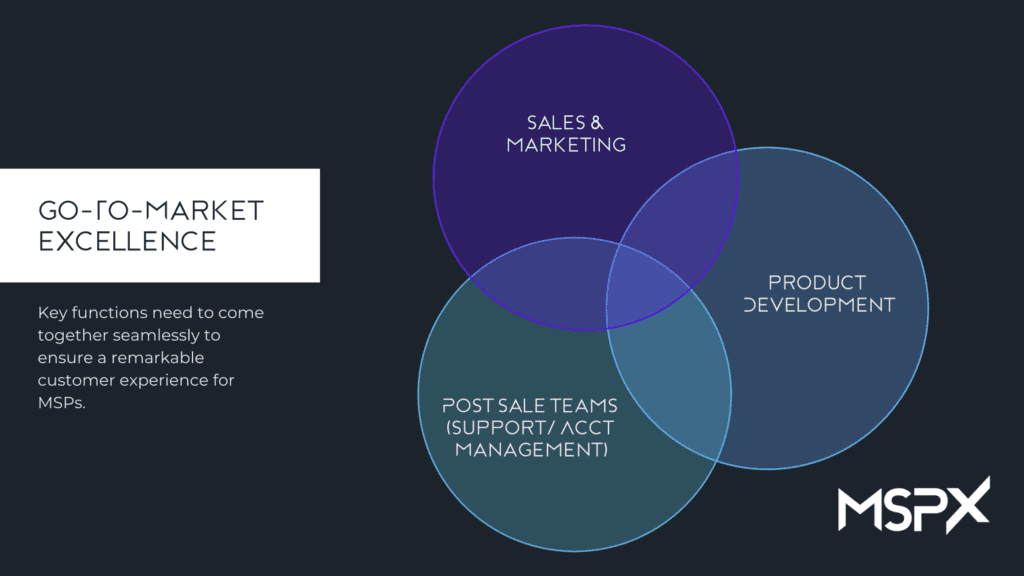

9. Not connecting product development with sales and marketing

MSPs get a lot of stick for not always being great at sales because let's face it, most MSPs are techies at heart. In reality, software vendors are not much different. Software companies are often led by founders with a technical heritage, people who are passionate about building technology products.

It is very easy to take a "if we build it, they will come" approach and create a strategy that is focused largely on product development without truly understanding how to build a sales organization. In many cases, sales and marketing teams may not even know what is coming down the pipe on the development roadmap and they can be left floundering when the product team announces that a new feature has been released and needs to be promoted to customers, even though it might not be that beneficial to MSPs. It's even worse when sales teams bang the drum about features MSPs need, but they simply go unheard by a product development team who have their own agenda.

This is where having an active, well engaged MSP advisory board can sometimes be really handy. However, the true value is in encouraging your sales team to provide product feedback and insight (and actually acting on it), since they are the people who are on the coal face talking to MSPs every day.

Your sales team is the best advisory board you will ever find. Having a sales and marketing team that is not actively engaged with the product development strategy is like going to war without intelligence. In this scenario, a salesperson is fighting an uphill battle to convince the customer that the business actually understands their needs and can respond to them.

Did you find this article useful?

If you would be interested in working with MSP-X to grow your MSP software business, you can learn more here.

By

By